Trading in Commodities Overview:

Commodity trading is a crucial segment of the financial markets, allowing investors to diversify their portfolios and hedge against various economic risks. This guide provides a detailed overview of what commodity trading entails, the different types of commodities, the markets where they are traded, the benefits and risks, and strategies for successful commodity trading.

Understanding Commodity Trading

Commodity trading involves buying and selling raw materials or primary agricultural products. These can be classified into two main categories:

- Hard Commodities: Natural resources that must be mined or extracted, such as gold, oil, and natural gas.

- Soft Commodities: Agricultural products or livestock, such as wheat, coffee, sugar, and cattle.

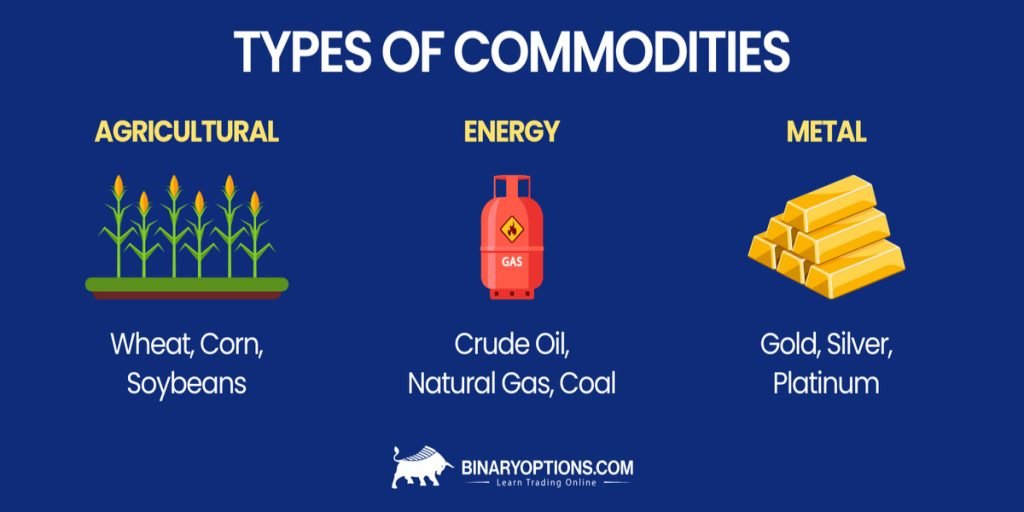

Types of Commodities

- Energy Commodities: Includes crude oil, natural gas, gasoline, and heating oil. These are essential for various industries and are highly sensitive to geopolitical events and economic changes.

- Metal Commodities: Encompasses precious metals like gold, silver, platinum, and industrial metals like copper and aluminum. These metals are vital for manufacturing and construction.

- Agricultural Commodities: Covers crops like wheat, corn, soybeans, and rice, as well as livestock like cattle and hogs. Agricultural commodities are influenced by weather conditions, disease, and global demand.

Commodity Markets

Commodities are traded on various exchanges worldwide, including:

- New York Mercantile Exchange (NYMEX): Primarily trades energy and metal commodities.

- Chicago Mercantile Exchange (CME): Deals in a wide range of commodities, including agricultural products and energy.

- London Metal Exchange (LME): Focuses on industrial metals.

- Intercontinental Exchange (ICE): Trades energy products, agricultural commodities, and financial products.

How Commodity Trading Works

Commodity trading can be done through:

- Spot Markets: Where commodities are bought and sold for immediate delivery.

- Futures Markets: Where contracts are bought and sold for delivery on a future date. Futures contracts specify the quantity of the commodity, the price, and the delivery date.

Benefits of Commodity Trading

- Diversification: Commodities often have low correlation with traditional asset classes like stocks and bonds, providing portfolio diversification.

- Inflation Hedge: Commodities can serve as a hedge against inflation since their prices tend to rise when inflation increases.

- High Liquidity: Many commodity markets are highly liquid, allowing for easy entry and exit from positions.

- Potential for High Returns: Due to volatility, there can be significant opportunities for profit in commodity trading.

Risks of Commodity Trading

- High Volatility: Commodity prices can be extremely volatile, influenced by geopolitical events, natural disasters, and changes in supply and demand.

- Leverage Risks: Commodity futures trading often involves leverage, which can amplify both gains and losses.

- Market Risk: Changes in global economic conditions can impact commodity prices significantly.

- Regulatory Risks: Commodity markets are subject to regulations that can change, impacting trading conditions.

Strategies for Successful Commodity Trading

- Fundamental Analysis: Involves analyzing supply and demand factors, geopolitical events, weather conditions, and economic indicators to predict commodity price movements.

- Technical Analysis: Uses historical price data and trading volumes to identify patterns and trends that may indicate future price movements.

- Hedging: Involves taking positions in commodity futures to offset potential losses in other investments or business operations.

- Speculation: Taking positions based on the anticipation of future price movements to profit from market volatility.

Best Practices for Commodity Trading

- Stay Informed: Keep abreast of global economic news, geopolitical events, and market reports that can impact commodity prices.

- Risk Management: Implement risk management strategies such as stop-loss orders, position sizing, and diversification to manage potential losses.

- Educate Yourself: Continuously educate yourself about the commodity markets, trading strategies, and risk management techniques.

- Use Reliable Platforms: Trade through reputable and regulated exchanges or brokers to ensure transparency and security.

The Bottom Line:

Commodity trading offers numerous opportunities for investors looking to diversify their portfolios, hedge against inflation, and capitalize on market volatility. However, it also comes with significant risks that require careful management. By understanding the fundamentals, staying informed, and employing sound trading strategies, investors can navigate the complex world of commodity trading and make informed investment decisions. Whether you are a novice or an experienced trader, continuous education and diligent risk management are key to success in the commodity markets.