Introduction

First-generation startups, characterized by their innovative and disruptive nature, are increasingly making their way into the stock market. These startups, founded by individuals who are often venturing into the world of entrepreneurship for the first time, bring fresh ideas and approaches to the market. As these companies navigate the complexities of going public, they face a unique set of challenges and opportunities that can significantly impact their growth and success.

Challenges Faced by First-Generation Startups

Entering the stock market can pose several challenges for first-generation startups. One of the primary hurdles is the rigorous regulatory requirements and compliance standards set by the Securities and Exchange Commission (SEC). These startups must adhere to strict reporting and disclosure guidelines, which can be daunting for founders who may not have prior experience in dealing with such regulations.

Moreover, the pressure to meet the expectations of shareholders and deliver consistent financial performance can be overwhelming for startups that are still in the early stages of growth. Maintaining transparency and communication with investors while managing the day-to-day operations of the business requires a delicate balance that many first-generation startups struggle to achieve.

Another challenge is the volatility of the stock market itself. The unpredictable nature of stock prices can impact the valuation of a startup, leading to fluctuations in investor confidence and potentially affecting the company’s ability to raise capital or attract new investors.

Opportunities for First-Generation Startups

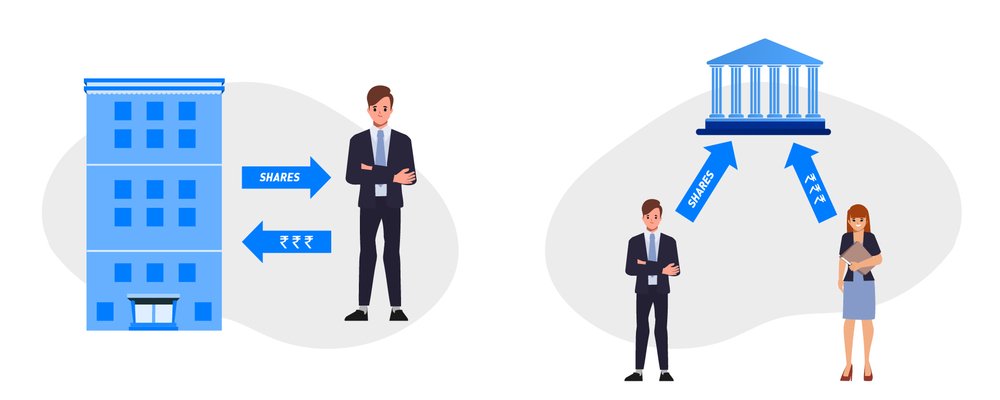

Despite the challenges, going public can open up a world of opportunities for first-generation startups. Access to public markets can provide these companies with a platform to raise substantial capital, enabling them to fund expansion plans, invest in research and development, and pursue strategic acquisitions.

Listing on the stock market also enhances the credibility and visibility of a startup, making it more attractive to potential customers, partners, and employees. The increased exposure can help first-generation startups establish their brand presence and differentiate themselves in a competitive market landscape.

Furthermore, being publicly traded can create liquidity for early investors and employees who hold equity in the company. This liquidity can incentivize talented individuals to join the startup, knowing that they have the opportunity to realize financial gains in the future.

Impact of First-Generation Startups Entering the Stock Market

The decision of a first-generation startup to go public can have a significant impact on various stakeholders, including founders, employees, investors, and the broader market ecosystem. For founders, the IPO represents a milestone achievement that validates their vision and hard work, while also signaling a new chapter of growth and expansion.

Employees of the startup may benefit from stock options and equity grants, which can become more valuable once the company goes public. This can boost morale, incentivize performance, and attract top talent to the organization.

Investors, both early backers and new shareholders, stand to gain from the potential returns generated by a successful IPO. The liquidity provided by the public markets allows investors to buy and sell shares more easily, creating opportunities for diversification and portfolio growth.

From a market perspective, the entry of first-generation startups can inject fresh energy and innovation into the stock market, driving competition and fostering a culture of entrepreneurship. These startups often bring disruptive technologies and business models that challenge incumbents and push the boundaries of industry norms.